Including your engagement letter as part of a client onboarding process won’t just improve the client experience you offer; it can also help increase efficiency and productivity. This letter is to confirm our mutual understanding of the terms of our engagement to provide accounting and review services for your firm. We are thrilled you have chosen our firm to provide quarterly compilation services for your business and an annual review. You may or may not need to include every member of your team who will be working on the engagement (although some government and accounting for uncollectible accounts receivable quasi-government clients will want this information). This might seem obvious, but for the contract to be official, you can’t have the client sign a generic letter and expect it to hold up.

This includes bank statements, invoices, receipts, payroll records, contracts, and tax documents. Also, state in clear terms the repercussions of your clients not meeting their obligations to you as their accountant. Once the parties have been identified and the engagement period set, it’s crucial to outline in clear and specific language the nci interactive stock chart services that you’ll be providing to the client. First off, identifying both parties in the accounting engagement letter ensures everyone involved understands who they are working with and the nature of the professional relationship.

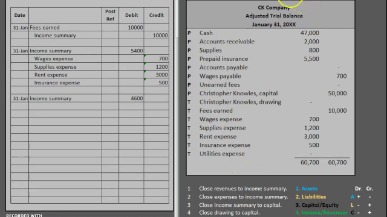

Services included

To protect yourself from time drains, minimize your professional liability, and maintain your firm’s profitability, you need to ensure you have an engagement agreement in place for each project. Many professional liability insurance providers require engagement letters, including the Tax Practitioners Board. This engagement letter includes the relevant terms that will govern the engagement for which it has been prepared.

- It tells them exactly what they’re paying for, giving them the right to question your services if there are needs not being met.

- Is the scope limited to a compilation service or is the client looking for a full audit?

- Under Client Responsibilities, outline what the client is expected to provide.

thoughts on “Accounting Engagement Letter A+ Sample + Guide”

Failure to provide the required information may result in delays or additional fees. Late payments will incur a fee of $X for each number days past the due date. If you are covering the cost of the software package, be sure to outline how much of the monthly fee is covering that.

Adapting Templates

Your accounting engagement letter should not only outline your responsibilities but the responsibilities of your client. For example, you may need certain bookkeeping or financial records from the client by a set time of the month in order to complete your tasks on time. Stating clear deadlines and tasks saves you trouble, and maybe even a customer, in the future. A bookkeeping engagement letter is a formal agreement between a bookkeeper and a client. It outlines the expectations, services, and terms of the relationship. The bookkeeping engagement letter should be reviewed and signed by both parties before any work begins.

Remember, accounting engagement letters form the cornerstone of a smooth and successful relationship between you and your clients. They define expectations, responsibilities, and terms of service, ensuring everyone is on the same page what is the quick ratio definition and formula from the outset. But a generic letter won’t do for every client – every engagement is unique, and your letter to each client should reflect that.

The longer answer is it may not always be possible to draft an engagement letter prior to starting a project if the project is particularly time sensitive. However, time sensitive projects have greater potential liability due to their rushed nature. This puts greater significance on having the signed agreement ahead of time to outline your liability and responsibility for the project.

This document protects both parties by setting clear expectations from the start of the relationship. It outlines the terms and conditions of a professional relationship between a bookkeeper and a client. As such, it aims to set clear expectations for both parties around the scope and responsibilities of the role. If you’re looking for simple workflow templates, which includes a bookkeeping client onboarding checklist, access our collection of 32 customizable accounting workflow templates.